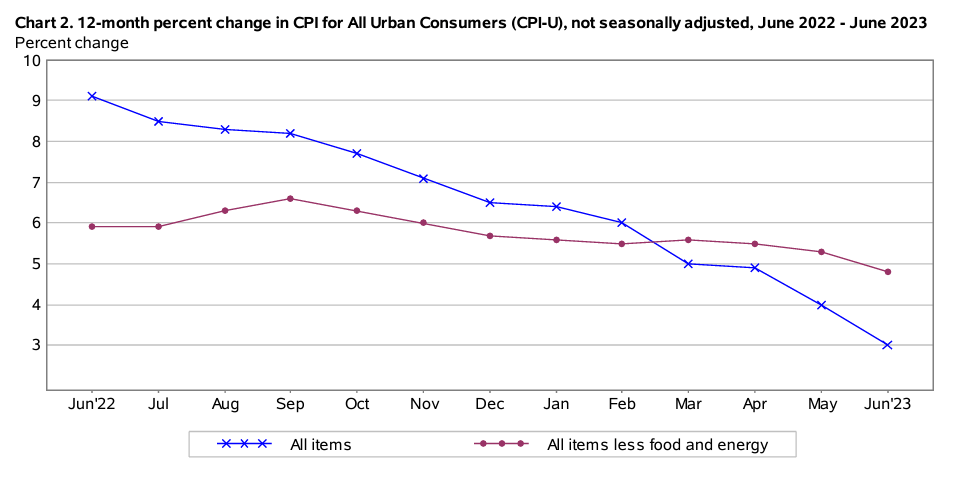

📊 The Consumer Price Index (CPI) has dropped to 3% year-over-year, signaling a significant monetary tightening. Real interest rates have surged by 1% in just one month, all thanks to falling inflation. 📉⚡️ The trend is apparent, and the Federal Reserve (FED) now faces the risk of recession and deflation if they overtighten. Will they be wrong, not just in starting the tightening process too late last year, but now potentially overdoing it as well? 🤔

The ongoing trajectory of the CPI warrants cautious consideration to avoid the dangers of recession and deflation. 😱📉 The risk of potential repercussions from an overly aggressive response is significant. In my opinion, they should skip the July hike and wait for the impact of positive real interest rates, which have only started to exist in the last few months. ⏰🤷♂️

Source: Bureau of Labor Statistics – U.S. Department of Labor

1 thought on “Assessing the US CPI Trend: ⬇️3% YoY 📉🔀 Further Hike(s) Ahead?”

Seeking answers to investing/wealth questions? DM me!

Subscribe for more content on damjancsiba.com

Comment